Key takeaways

- Financing is a planning tool, not a last minute rescue plan

- The best option depends on your timeline, your equity, and your comfort with risk

- Compare total cost, monthly payment, and flexibility, not just the lowest payment

- Keep an emergency cushion and a project contingency so one surprise does not derail you

- Clear scope and a clear estimate turn financing into a choice instead of a scramble

Most homeowners do not want a loan. They want the project done right without financial regret. Around Verona and Madison, we see people choose financing because they want to protect savings, spread payments, or move forward now instead of waiting years while the kitchen slowly drives them crazy.

The biggest mistake is treating financing like a last step. If financing is part of your plan, bring it into the conversation early. It can affect timing, material choices, and how you schedule the project.

A lot of stress disappears when the numbers are clear. Once you have a real scope and a real estimate, financing becomes a choice, not a scramble. That is why planning first matters. It gives you leverage.

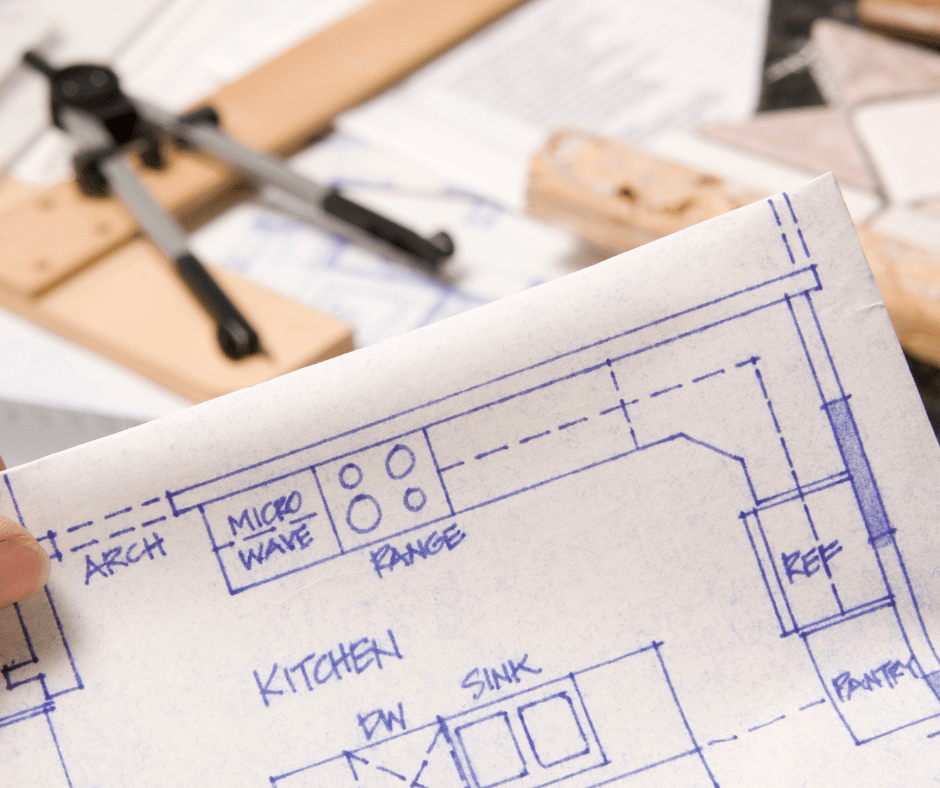

Step one: Know what you are actually budgeting for

A practical remodel budget has three parts:

- The project cost based on scope and selections

- A contingency for surprises

- Temporary lifestyle costs if the project affects routines, like eating out more often during a kitchen remodel

Contingency does not mean you expect disaster. It means you respect reality. Older homes in the Madison area can reveal hidden issues once walls open, and it is better to be prepared than to panic.

The most common ways people finance a remodel

There is no one perfect option. The best choice depends on your goals and your comfort level.

Cash savings

Why people like it: no approval process, no interest, no monthly payment

What to watch: do not drain your emergency cushion to zero

We have seen homeowners pay cash and then feel stressed because there is no buffer left for life. Keep your emergency fund separate from remodel money.

Home equity loan

Why people like it: predictable payment and fixed term options are common

What to watch: it is secured by the home and may include closing costs

This can be a good fit for a clearly defined project with a stable budget.

HELOC

A home equity line of credit can work well for projects that happen in phases.

Why people like it: flexibility and you pay interest only on what you use

What to watch: rates can be variable and it takes discipline to stay on plan

Cash out refinance

Why people like it: can roll remodeling cost into the mortgage

What to watch: refinancing depends heavily on your current mortgage rate and goals

This option is very personal. For some homeowners it makes sense. For others, it costs more long term.

Personal loan

Why people like it: often faster, no lien on the home

What to watch: rates can be higher and terms can be shorter

This can work for smaller projects or when equity financing is not ideal.

Partner financing through a lender

Some contractors offer financing options through a banking partner. AF Construction highlights financing options through Regions Bank, which can include promotional offers depending on availability and borrower qualifications.

Why people like it: convenient and tailored to home improvement

What to watch: read terms carefully and compare total cost with other options

Simple advice: compare any lender offer against at least one other option so you are choosing, not guessing.

How to compare financing options like a grown up

Most people focus on monthly payment. Monthly payment matters, but it is not the whole story.

Compare using three lenses:

- Total cost over time, including fees

- Monthly payment comfort level that leaves room for life

- Flexibility if scope changes or timelines shift

Also ask about early payoff. Some loans penalize you for paying off early. Others do not.

Timing and start dates

Financing can slow a project if it starts late. Approvals, appraisals, and paperwork take time. If you want a start date on the calendar, start financing conversations early so you are not rushing later.

Local reality check: trades and suppliers in this area stay busy. A clean plan helps you schedule confidently. A last minute scramble can create avoidable delays.

How milestone payments typically work

Many remodels use milestone payments. That is normal. It supports materials, labor, and scheduling commitments.

Questions to ask early:

- What deposit is required to schedule the start date

- When major payments occur during the project

- How changes are documented and priced

- How selections impact final cost

- What triggers the final payment

A contractor who explains this clearly is usually a contractor who runs the project clearly.

Simple money boundaries that keep remodeling from becoming stressful

These boundaries are not fancy. They are effective.

- Keep an emergency cushion separate from the remodel budget

- Build a contingency into the plan so one surprise does not break the project

- Borrow for the parts that improve daily life, not just the parts that photograph well

- Avoid stacking high interest debt unless you have a clear payoff plan

- Choose a monthly payment that still lets you breathe

Financing should support your life, not tighten it.

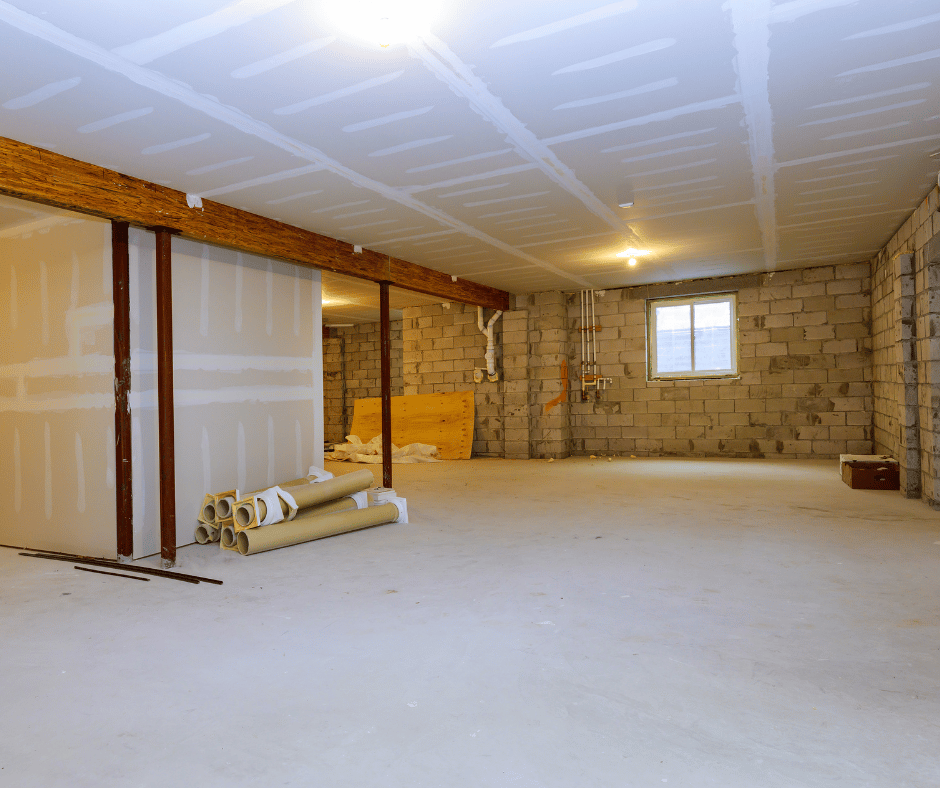

Financing and resale value

People ask whether a remodel pays for itself. The better question is whether it improves daily life and keeps your home competitive for your neighborhood. Kitchens, bathrooms, and well planned basement finishing often deliver strong value, but results vary by scope and quality.

The safest bet is quality work and smart choices that age well. Trend chasing can be expensive.

If you are in Verona, Madison, Mount Horeb, McFarland, or Oregon and you are weighing financing options, start with a consult and a clear estimate. Clarity turns the money side from stressful into manageable.

FAQs

Should I start financing before or after I get an estimate

Start exploring early, but finalize once you have clear scope and pricing. That keeps you from borrowing the wrong amount.

Can I finance only part of my remodel

Yes. Many homeowners combine cash with financing to show discipline and keep payments comfortable.

Will financing slow down my project

It can if you wait until the last minute. Planning early helps protect the schedule.

How do milestone payments usually work for a remodel in this area

Milestones vary by contractor and project type, but they are typically tied to meaningful progress points and materials ordering.

Is contractor offered financing always the best deal

Not always. It can be convenient, but you should compare terms and total cost so you choose confidently.